This is the menu item that you read on the hompage.

Korea Ocean Business Corporation

- Introduction to KOBC

- Main Business

- Investor Relations

- Public participation

- ESG Management

Introduction to KOBC

Main Business

-

Support to secure ships (Investment Program)

-

Container box investment program

Secondary preservation/special guarantee program for environment-friendly facility improvement

-

Investment program for port terminals and logistics facilities

-

Management support for the shipping industry(Covid-19 support)

-

Shipping policy business operation

Support for conversion to environment-friendly ship

Certified Excellent Shipping Company and Shipper

Operation of National Essential Ships

Seaborne freight announcement system · Shipping transaction unfair act reporting center

-

Training industrial specialists

Cultivation of manpower for shipping finance · shipping, port logistics

Investor Relations

Public participation

ESG Management

Search

What information do you need from KOBC?

Popular search terms

Main Business

Maritime Finance Global LeaderShip introduction guarantee program

Ship introduction guarantee

The Ship Introduction Guarantee Program is a guarantee initiative by which the KOBC provides debt guarantees to cover risk of default by shipping companies regarding funds borrowed from creditors (financial institutions, etc.) when a domestic shipping company introduces new ship builds or second-hand Ships.

Feature and Benefit

- Reinforcing credit of shipping companies, improving repayment possibility for financial institutions, and revitalizing ship finance

- Overseas financial institutions (creditors) debt guarantee

Main guarantee conditions

| Classification | Details |

|---|---|

| Guarantee beneficiary | Creditors of main debt contract (financial institution that issues loans) |

| Guarantee period | Within financial period of main debt |

| Guaranteed amount | Financial amount subject to guarantee |

| Guarantee ratio | 95% |

| Guarantee amount | Guaranteed amount × guarantee ratio |

| Guarantee rate | Basic rate - discount rate + premium rate |

| Guarantee fee | Guarantee amount × Guarantee rate |

| Guarantee debt* | The amount of outstanding principal multiplied by guarantee ratio and equivalent of outstanding interest |

| Installment requirement* | Criteria for lump-sum payment of guarantee fee : Guarantee fee for Senior Loan of KRW 2.5 billion or more Guarantee fee for Junior(Subordinated) Loan of KRW 2 billion Guarantee period: six years or more (Small and medium-sized shipping companies: Two years or more) *Both requirements must be met, and small and medium-sized shipping companies can be granted eased installments |

※ For more details, refer to the KOBC’s guarantee agreement Ⅱ at the time of consultation.

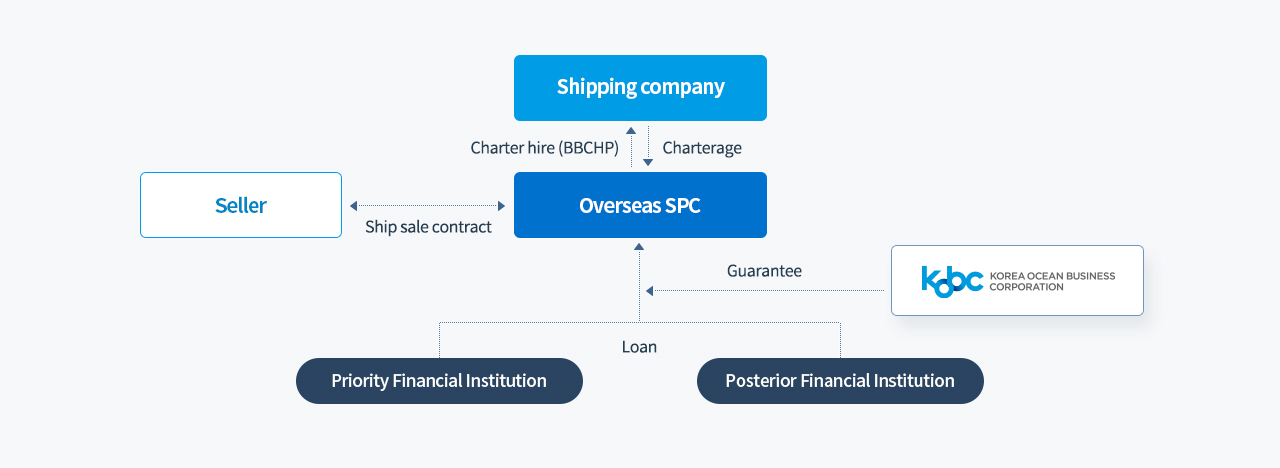

Financial structure diagram (Example of use of ship investment company)

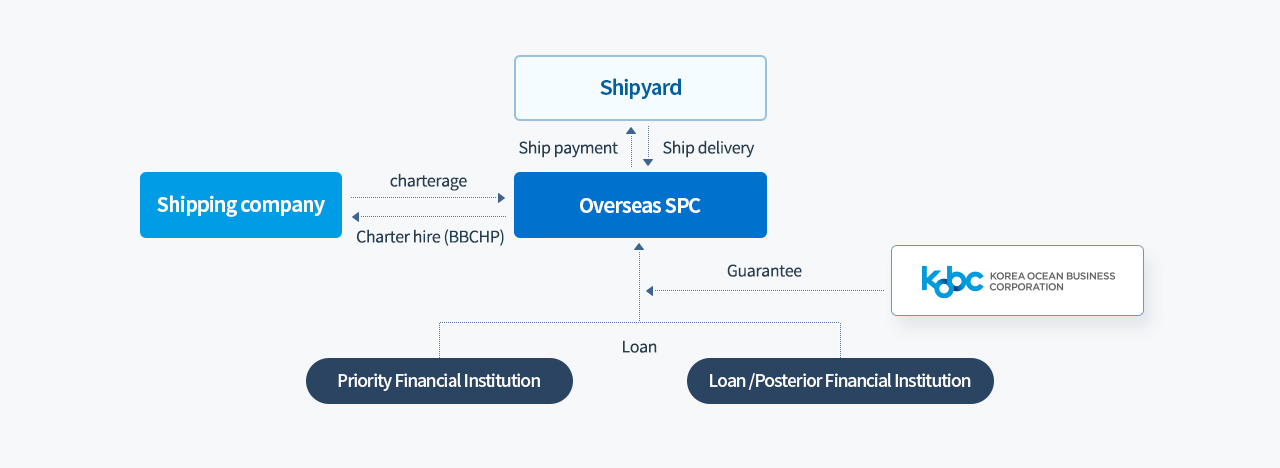

Structure diagram for new shipbuilding introduction

Shipyard→Overseas SPC:Ship delivery, Overseas SPC:Ship delivery→Shipyard:Ship payment

Shipping company→Overseas SPC:Charterage, Overseas SPC→Shipping company:Charter hire (BBCHP)

(Priority Financial Institution+Posterior Financial Institution)→Overseas SPC:Loan, Korea Ocean Business Corporation:Guarantee