This is the menu item that you read on the hompage.

Korea Ocean Business Corporation

- Introduction to KOBC

- Main Business

- Investor Relations

- Public participation

- ESG Management

Introduction to KOBC

Main Business

-

Support to secure ships (Investment Program)

-

Container box investment program

Secondary preservation/special guarantee program for environment-friendly facility improvement

-

Investment program for port terminals and logistics facilities

-

Management support for the shipping industry(Covid-19 support)

-

Shipping policy business operation

Support for conversion to environment-friendly ship

Certified Excellent Shipping Company and Shipper

Operation of National Essential Ships

Seaborne freight announcement system · Shipping transaction unfair act reporting center

-

Training industrial specialists

Cultivation of manpower for shipping finance · shipping, port logistics

Investor Relations

Public participation

ESG Management

Search

What information do you need from KOBC?

Popular search terms

Main Business

Maritime Finance Global LeaderCredit assurance program

Credit guarantee

The project provides guarantee support for fulfillment of corporate debt so that shipping companies with insufficient credit or collateral can get loans from financial institutions for emergency working capital financing. However, the project is provided only in cases specified in Article 7.1 of the Enforcement Decree of the Korea Ocean Business Corporation Act.

Feature and Benefit

- To ensure corporations with public trust (credit rating AAA) can easily procure necessary business funds from financial institutions by supplementing insufficient credit.

- Lowering procurement costs for shipping companies that were unable to procure due to poor credit ratings or procured at high interest rates

Main guarantee conditions

| Classification | Details |

|---|---|

| Guarantee beneficiary | Creditors of main debt contract (financial institution that handles loans) |

| Guarantee period | Within 1 year from the date of guarantee issuance |

| Guarantee amount | Guaranteed amount × Guarantee ratio (determined according to company's financial condition) |

| Guarantee rate | Calculated based on the basic rate by credit rating, rate of special terms and conditions, and factors of discounts and premiums |

| Guarantee debt | The amount equal to the unpaid principal multiplied by guarantee ratio and amount equivalent to unpaid interest. |

| Bond conservation | Subrogation rights to the debtor |

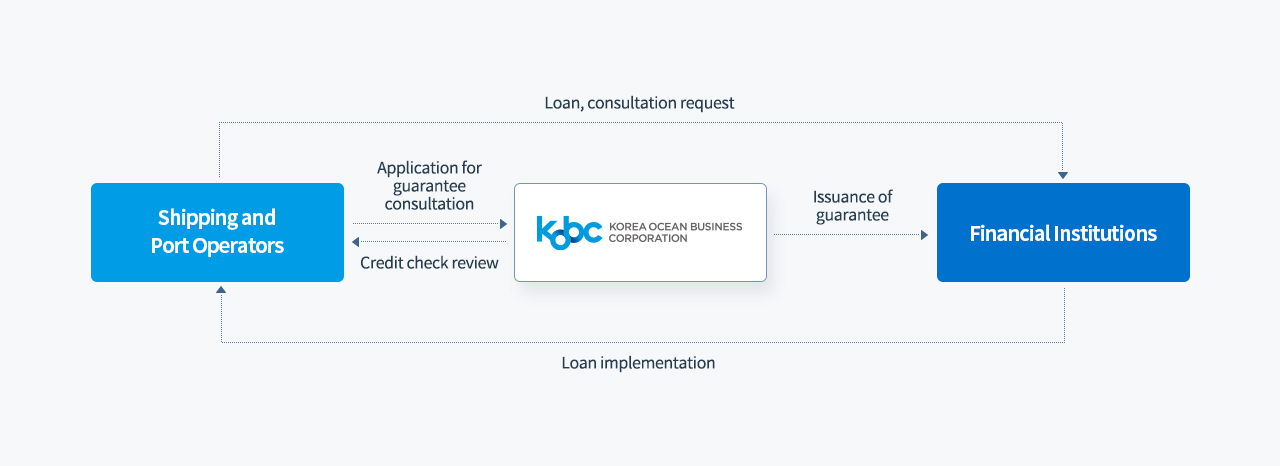

Guarantee structure diagram (examples)

Flow chart of credit guarantee

Korea Ocean Business Corporation→Financial Institutions:Issuance of guarantee

Shipping and Port Operators→Korea Ocean Business Corporation:Application for guarantee consultation

Korea Ocean Business Corporation→Shipping and Port Operators:Credit check review

Shipping and Port Operators→Financial Institutions:Loan, consultation request

Financial Institutions→Shipping and Port Operators:Loan implementation