This is the menu item that you read on the hompage.

Korea Ocean Business Corporation

- Introduction to KOBC

- Main Business

- Investor Relations

- Public participation

- ESG Management

Introduction to KOBC

Main Business

-

Support to secure ships (Investment Program)

-

Container box investment program

Secondary preservation/special guarantee program for environment-friendly facility improvement

-

Investment program for port terminals and logistics facilities

-

Management support for the shipping industry(Covid-19 support)

-

Shipping policy business operation

Support for conversion to environment-friendly ship

Certified Excellent Shipping Company and Shipper

Operation of National Essential Ships

Seaborne freight announcement system · Shipping transaction unfair act reporting center

-

Training industrial specialists

Cultivation of manpower for shipping finance · shipping, port logistics

Investor Relations

Public participation

ESG Management

Search

What information do you need from KOBC?

Popular search terms

Main Business

Maritime Finance Global LeaderInvestment program for port terminals and logistics facilities

Port terminals

Logistics facility investment

Port terminal·Logistics facility investment program support funds for acquisition of domestic and overseas terminals, logistics facilities, and port logistics infrastructure for shipping companies and port operators for purpose of supporting expansion of port logistics network and entry into the overseas port logistics market of national companies.

Feature and Benefit

- Contributing to long-term and stable business operation of the port logistics business by participating as a financial investor (FI) in case of securing operation rights

(management rights) for existing facilities and new construction and development - Support with various financial structures, such as equity, bond, PF, fund to expand business flexibility of applied companies

Main support and condition

| Classification | Details |

|---|---|

| Investment target | Domestic and foreign port terminals and logistics facilities (CY, CFS, and logistics centers)* |

| Supporting structure | - Investment in equity and bonds of target assets (including acquisition of beneficiary certificates under the Capital Market Act) - Loan guarantees for port and logistics companies |

| Investment proportion | (Equity investment) within the share of investment applicant (large shareholder) (Bond investment) apply in consideration of collateral value, credit rating, and business feasibility |

| Investment period | Discussion in consideration of investment structure and financial conditions |

| Transaction currency | KRW or USD or target country currency |

| Investment profit rate | Consider account procurement cost and credit rating, risk of host country, and investment conditions |

| Repayment method | Agreement through comprehensive consideration of target for support, project structure, and project feasibility results |

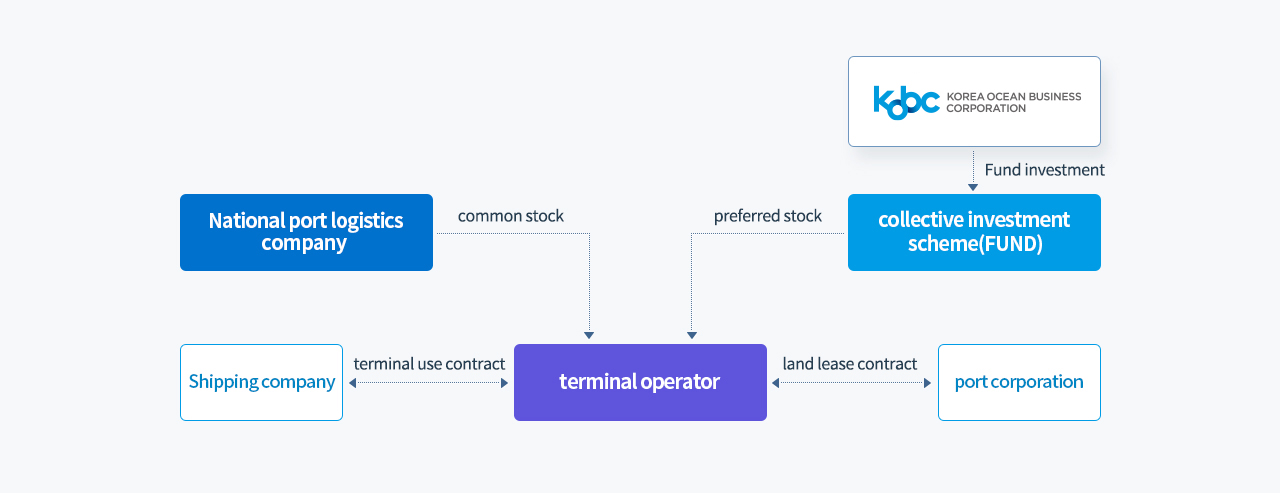

Financial structure diagram (terminal equity investment example)

National port logistics company→terminal operator:common stock

terminal operator↔Shipping company:terminal use contract

Korea Ocean Business Corporation→collective investment scheme (FUND):Fund investment

collective investment scheme (FUND)→terminal operator:preferred stock

terminal operator↔port corporation:land lease contract