This is the menu item that you read on the hompage.

Korea Ocean Business Corporation

- Introduction to KOBC

- Main Business

- Investor Relations

- Public participation

- ESG Management

Introduction to KOBC

Main Business

-

Support to secure ships (Investment Program)

-

Container box investment program

Secondary preservation/special guarantee program for environment-friendly facility improvement

-

Investment program for port terminals and logistics facilities

-

Management support for the shipping industry(Covid-19 support)

-

Shipping policy business operation

Support for conversion to environment-friendly ship

Certified Excellent Shipping Company and Shipper

Operation of National Essential Ships

Seaborne freight announcement system · Shipping transaction unfair act reporting center

-

Training industrial specialists

Cultivation of manpower for shipping finance · shipping, port logistics

Investor Relations

Public participation

ESG Management

Search

What information do you need from KOBC?

Popular search terms

Main Business

Maritime Finance Global LeaderP-CBO support program

P-CBO support

The program allows the Corporation to support liquidity supply to shipping companies by acquiring some securitized bonds (posterior) when a supporting company is included in the 「COVID-19 damage response liquidation company guarantee」 of Korea Credit Guarantee Fund (the KCGF). This program is temporarily operated to help overcome challenges posed by COVID-19.

Feature and Benefit

- Streaming financing of shipping companies through the KOBC’s acquisition of posterior bonds by expanding opportunities for shipping companies to participate in

「COVID-19 damages response liquidation company guarantee」

Main guarantee conditions

| Classification | Details |

|---|---|

| Method of support | Acquisition of posterior securitized bonds of the KCGF P-CBO specialized in liquidation |

| Eligibility | Companies that comply with the KCGF's internal regulations (in-house review criteria) of shipping companies affected by COVID-19 |

| Credit rating | Mid-sized company: External corporate bond grade BB- or higher, small and medium-sized businesses: The KCGF's guarantee evaluation level K10 or higher |

| Maturity | 3 years |

| Repayment | Lump-sum repayment at maturity of principal and interest |

| Interest rate | Classification of small and medium-sized companies and differentiation by credit rating |

| Purchase deadline | Consider the KCGF P-CBO issuance schedule (until the KOBC’s budget is available) |

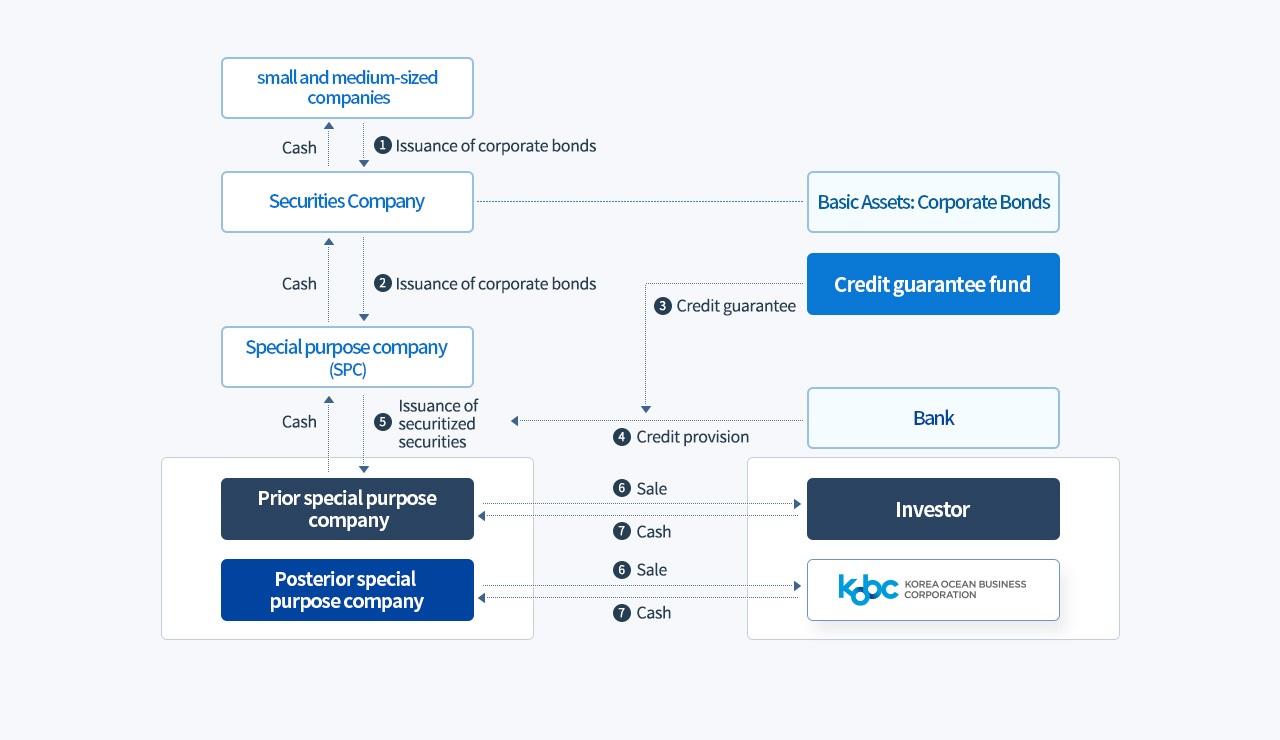

Structure of support

Repayment/small and medium-sized companies→Securities Company:①Issuance of corporate bonds

Securities Company---Basic Assets: Corporate Bonds Securities Company→Repayment/small and medium-sized companies:Cash

Securities Company→Special purpose company (SPC):②Issuance of corporate bonds

Credit guarantee fund→③Credit guarantee→④Credit provision Bank→④ Credit provision⑤→Issuance of securitized securities

Special purpose company (SPC)→Securities Company:Cash

Special purpose company (SPC)→Prior special purpose company, Posterior special purpose company:Issuance of securitized securities

Prior special purpose company, Posterior special purpose company:Issuance of securitized securities→Special purpose company (SPC):Cash

Prior special purpose company→Investor:⑥Sale

Investor→Prior special purpose company:⑦Cash

Posterior special purpose company→Korea Ocean Business Corporation:⑥Sale

Korea Ocean Business Corporation→Posterior special purpose company:⑦Cash